Veteran Wall Street Lawyer Bill Singer Cracks FINRA Code of Secrecy

October 3, 2016

This is an update of "WTF? FINRA AWC OBA LPL RS CK" (BrokeAndBroker.com Bog, September 30, 2016)

If you're a supervisor on Wall Street, it sort of goes without saying that you need to supervise. Unfortunately, a number of folks at Wells Fargo may be having an "ah ha!" moment as they read those wise words about the mechanics of supervision. In a recent FINRA regulatory settlement, the self regulator presented us with the case of a supervisor who seems to have had trouble engaging in effective supervision. In reading through the fact pattern of this case, you may be reminded of a moth getting too close to the flame.

Case In Point

For the purpose of proposing a settlement of rule violations alleged by the Financial Industry Regulatory Authority ("FINRA"), without admitting or denying the findings, prior to a regulatory hearing, and without an adjudication of any issue, Michael Scott Lincoln submitted a Letter of Acceptance, Waiver and Consent ("AWC"), which FINRA accepted. In the Matter of Michael Scott Lincoln, Respondent (AWC 2015045352901, September 20, 2016).

In 1998, Lincoln entered the securities industry and in 2004, he was registered with FINRA member firm LPL Financial LLC. The AWC asserts that Lincoln had no prior disciplinary history in the securities industry.

The Unknown RS

Between October 2009 and September 2013, Lincoln supervised an LPL registered representative assigned to Lincoln's branch office. The AWC refers to this supervised registered rep only as "RS."

RS Borrows From Lincoln

Sometime around December 2011, the AWC asserts that Lincoln loaned funds to RS, who was the sole owner and operator of Hawaiian real estate that he was developing into a vacation rental property and which opened for business in 2012. Oddly, the AWC does not set forth the amount of Lincoln's loan to RS or any of the terms for repayment.

The AWC asserts that RS had failed to notify LPL of his real estate activity, which the AWC characterizes as an outside business activity ("OBA").

RS Borrows From LPL Customers

From about May 2009 through November 2012, RS purportedly borrowed about $2.25 million from seven LPL customers for the purpose of purchasing Hawaiian real estate and constructing the previously referenced rental property. Each of the seven lenders were LPL customers of RS at the time of the loans.

2012/2013: Lincoln On Notice of RS's OBA

The AWC asserts that by February 2012, Lincoln knew that "RS's real estate investment in the property was an outside business activity" because Lincoln was, by then, aware of the involvement of outside investors in the property. Similarly, the AWC asserts that Lincoln further manifested his knowledge of RS's OBA in:

- March 2013, when Lincoln had e-mailed a link to the property's website to an LPL customer; and

- in May 2013, when Lincoln knew that RS had a separate bank account for the property.

CK

Enter, stage left, yet another registered representative (referenced in the AWC only by her monogram) supervised by Lincoln:

In August 2013, CK, who also loaned money to RS for the outside business, submitted a disclosure form to the Firm in which she stated that her loan to RS was for RS's "home." In August 2013, RS submitted disclosure forms to the Firm in which he stated that his loans from CK and Lincoln were for his "personal residence."

Twiddling Supervisory Thumbs

By way of recap, the AWC asserts that Lincoln loaned money to RS for the development of a vacation rental property. Further, the AWC asserts that registered rep CK misstated on a disclosure form submitted to LPL that her loan to RS was for a "home," rather than for the OBA of developing the vacation rental business. Additionally, the AWC asserts that RS submitted to LPL a disclosure that falsely presented the loans from CK and Lincoln as being for his personal residence rather than the OBA.

Given those predicates, the AWC alleges that Lincoln was aware of RS had not disclosed to LPL his OBA. Accordingly, the AWC concludes that Lincoln failed to properly supervise because he did not investigate, prevent and/or report RS's misconduct to LPL. Also, although Lincoln knew that CK's and RS's above-referenced disclosure forms failed to disclose the OBA nature of RS's activity (in contradistinction to use for a home/personal residence), the supervisor still approved the forms. FIINRA deemed Lincoln's conduct in this regard to constitute a violation of NASD Rule 3010(b) and FINRA Rule 2010.

As to RS's borrowing from seven LPL customers, the AWC asserts that LPL's written procedures prohibited registered representatives from borrowing money from a customer subject to certain exceptions not applicable here. Although Lincoln knew of the improper borrowing by June 2013, the supervisor did not investigate the activity and did not report the undisclosed loans to LPL. FINRA deemed Lincoln's conduct to constitute a violation of NASD Rule 3010(b) and FINRA Rule 2010.

Answering "NO"

The AWC alleges that in July 2012 and July 2013, Lincoln submitted LPL compliance questionnaires on which he wrongly responded "NO" to the question of:

Have you, or any related person or entity, borrowed or loaned any money or securities from or to another individual or entity?

Pointedly, Lincoln had personally loaned funds to RS in December 2011. The AWC observes that Lincoln's loan had not been repaid by July 2013.

During a July 2013 LPL compliance examination of Lincoln's branch office, he purportedly answered "NO" to the query:

Do you have any concerns with any financial advisors or other personnel under your supervision?

In addressing Lincoln's alleged lack of "concerns," in July 2013, the AWC offers this:

[I]n the letter, Lincoln stated that he had "no [c]ompliance or [s]upervision concerns regarding [RS] becoming a [Firm] OSJ branch manager."

At the time Lincoln made these statements to the Firm, he had concerns about

RS's compliance with Firm policies and applicable FINRA rules, because Lincoln

knew that RS was engaged in an outside business activity that had not been

disclosed to the Firm, and knew that RS had obtained unauthorized loans from

Firm customers. Therefore, Lincoln's statements were false.

Home Run

In July and August 2013, Lincoln submitted disclosure forms to LPL in which he described the purpose of his loan to RS as related to the completion of his subordinate's "home."

SIDE BAR: Note that the AWC previously asserted that in July 2012 and July 2013, Lincoln denied having borrowed or loaned money to any third party. Either Lincoln did or didn't disclose the loan in July 2013. Which is it?

Regardless of the AWC's inconsistent chronology of Lincoln's loan disclosure, it appears that the supervisor falsely stated that the loan was for RS's home. Further, Lincoln purportedly knew that RS was continuing to be involved in a non-disclosed OBA.

August 2014 Compliance Conversation

If this AWC were a movie, we would see the screen filled with pages of a calendar ripping off and falling to the floor. About a year's worth of time passes without explanation and we find ourselves at an August 2014 conversation between an LPL Compliance Examiner and Lincoln concerning:

[RS]'s vacation rental property and loans from Firm customers. During these discussions, Lincoln told the Firm compliance employee that he had recently learned that CK and Firm customers were involved in RS's vacation rental property. Because Lincoln knew, by no later than February 2012 and June 2013, that CK and Firm customers, respectively, had loaned RS funds for his unapproved outside business activity, Lincoln's statement to the Firm's compliance employee was false.As a result of the foregoing conduct, Lincoln violated FINRA Rule 2010.

Sanctions

In accordance with the terms of the AWC, FINRA imposed upon Lincoln a $15,000 fine; and a 6-month-suspension from association with any FINRA member in any principal capacity and a 4-month suspension from associating with any FINRA member in any capacity, to be served concurrently.

Bill Singer's Comment

In terms of the presentation of the underlying facts, compliments to FINRA on a job well done. Given the many nuances of this case, the AWC tackled the facts in a lucid manner and gave us a fairly decent picture of who did what and when.

The monetary sanction of $15,000 is certainly a measured one and the imposition of different Principal-only and All-Capacities suspensions shows that much thought was given to the terms of settlement. For my part, it strikes me that the terms of this settlement were far too benign and I'm not quite sure what additional lapses a supervisor would need to engage in for FINRA to impose a Principal-only Bar. As such, Lincoln appears to have benefited from some superb lawyering.

By way of adding a bit more texture to the underlying facts in this settlement, note that online BrokerCheck records as of September 29, 2016, disclose under the heading "Customer Dispute - Pending" the following allegations pertaining to a civil lawsuit filed in California sometime around November 2015:

PLAITIFFS [sic] ALLEGE BREACH OF FIDUCIARY DUTY, CONSTRUCTIVE FRAUD, UNFAIR BUSINESS PRACTICES, VIOLATION OF CA CORPORATIONS LAWS, PROFESSIONAL NEGLIGENCE, AND BREACH OF DUTY TO SUPERVISE IN CONNECTION WITH LOANS THEY MADE TO ANOTHER REPRESENTATIVE (OTHER FIRM EMPLOYEE) IN 2011 AND 2012 TOTALING $850,446.57 TO DEVELOP INVESTMENT PROPERTY. REPRESENTATIVE LINCOLN DENIES ALL CLAIMS, SPECIFICALLY INCLUDING BUT NOT LIMITED TO THE CLAIM THAT HE HAD ANY KNOWLEDGE OF, PARTICIPATION IN, OR RESPONSIBILITY FOR THE ALLEGED "INVESTMENT PROPERTY" ACTIVITY INVOLVING THE PLAINTIFFS AND [OTHER FIRM EMPLOYEE]. REPRESENTATIVE LINCOLN MAINTAINS THAT HE ACTED APPROPRIATELY AT ALL TIMES, INCLUDING WITH RESPECT TO HIS SUPERVISION OF FORMER REPRESENTATIVE, [OTHER FIRM EMPLOYEE].

For reasons that may make sense to FINRA but only confound me, this regulatory settlement largely involves Lincoln's failed supervision of RS, who was, in fact, registered with a FINRA member firm during the times relevant to this case and was subject to the self-regulatory organization's jurisdiction. This key participant in the failed supervision, this individual who also seems to have engaged in misconduct in his own right, this individual's name is hidden from us by FINRA and we are left with only the monogram of "RS." According to the BrokerCheck disclosure, the undisclosed OBA involved a whopping $850,000-plus in disputed investments. Not exactly chump change.

As I have long and often argued, this policy of regulatory hide-and-seek is baffling, particularly in cases where the unidentified, initialed participant has either committed wrongdoing in his or her own name and/or has caused another registered individual or registered entity to engage in misconduct.

UPDATE October 2016

I like a challenge - actually, I love a challenge. With that in mind, I was more than a bit excited about cracking FINRA's seemingly impenetrable code, which hid the names of "RS" and "CK." How could I hack into FINRA's many, many layers of digital encryption and penetrate into the very inner sanctum of this Wall Street overseer? I feared that I lacked the resources. Clearly, I would need to gain access to top secret super computers with the abilities to perform billions of code-breaking functions in a second. I would need to pay mega-bucks to former CIA, NSA, and KGB operatives to help me make sense of the massive amounts of data that would be placed before my eyes. Undaunted, I took a deep breath, brewed gallons of coffee, and sat down to the impossible task before me.

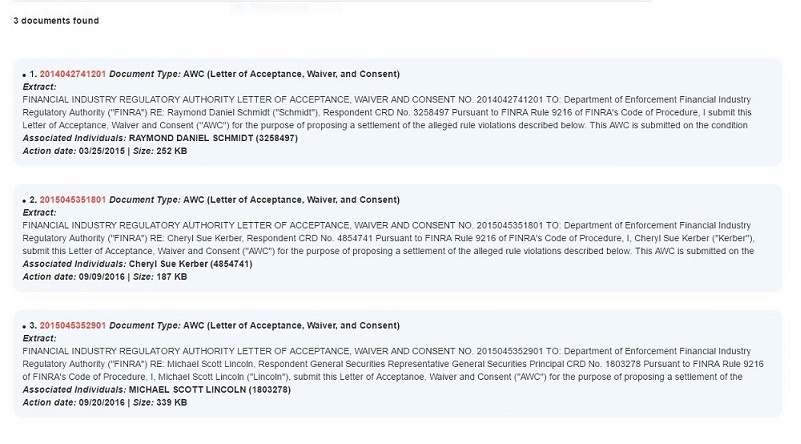

I am surprised and happy to report to you that my attempt to crack FINRA's code was a rather short and easy one. I simply logged on to FINRA's "Disciplinary Actions Online" webpage and entered into the "Document Text" field this search:

Hawaii real estate LPL

Lo and behold, three and only three search results were presented:

The third result is none other than Respondent Michael Scott Lincoln, the featured subject of the original BrokeAndBroker.com Blog posting on which this Update is premised.

Who were the other two named individuals in the three search results? Would I be able to put the pieces of the puzzle together? Now . . . lemme see here . . . how can I possibly decipher FINRA's triple encrypted state-of-the-art unbreakable scrambled references to "RS" and "CK." What am I to make out of the other two results: "Cheryl Sue Kerber" and "Raymond Daniel Schmidt." "CSK". "RDS". Oh my, those are three initials and, at first glance, they bear absolutely no resemblance to "RS" and "CK". Is there any way out of this complex maze?

Oh wait, maybe . . and I realize that this is simply a wild stab in the dark but, whoa!, what if we delete the middle names of "Sue" and "Daniel" and just go with the first and last names of "Cheryl Kerber" and "Raymond Schmidt?"

That's no good. "Cheryl Kerber" doesn't bear any relation to "RS" and "Raymond Schmidt" doesn't bear any relationship to "CK." Perhaps I am truly in over my head trying to break FINRA's code?

Hold on . . . wait a minute . . . could it . . . perhaps? Yes!!! If I use my computer to transpose "Raymond Schnmidt" with "RS" and "Cheryl Kerber" with "CK" that sort of looks promising. I'm not going to go so far as to suggest that "Raymond Schmidt" could be the "RS" referred to in the Lincoln AWC and/or that "Cheryl Kerber" could be the "CK" referred to in the Lincoln AWC but, you gotta admit, it seems like there is a possibility, vague as the odds may be, that we have at least one of the two folks involved with Lincoln's alleged failed supervision.

Of course, in order to better figure at whether we cracked the code, let's go back online to FINRA's BrokerCheck website and click on the results for Schmidt and Kerber. It can't be that simple, can it? After all, FINRA has gone to excruciating steps and implemented unending layers of encryption and secrecy to prevent the industry and the public from figuring out the identities of "RS" and "CK" in the Lincoln AWC. Hang on to your seats, I'm going in!

For the purpose of proposing a settlement of rule violations alleged by the Financial Industry Regulatory Authority ("FINRA"), without admitting or denying the findings, prior to a regulatory hearing, and without an adjudication of any issue, Raymond Daniel Schmidt and Cheryl Sue Kerber submitted separate Letters of Acceptance, Waiver and Consent ("AWC"), which FINRA accepted.

- In the Matter of Raymond Daniel Schmidt, Respondent (AWC 2014042741201, March 26, 2015).

- In the Matter of Cheryl Sue Kerber, Respondent (AWC 2015045351801, September 9, 2016).

Schmidt AWC

The Schmidt AWC asserts that Schmidt had entered the industry in 1999 and registered with LPL in July 2006, where he remained until his September 24, 2014, termination, which LPL characterized as a resignation while under the firm's internal review. The Schmidt AWC asserts that Schmidt had no prior disciplinary history in the securities industry.

Could this Respondent Schmidt possibly be the "RS" referenced in the Lincoln AWC? Let's see what the Schmidt AWC says:

As more fully summarized in the Schmidt AWC, FINRA alleged that:

From approximately May 2009 through November 2012, Schmidt violated NASD Rule 2370 and FINRA Rules 3240 and 2010 by borrowing approximately $2.25 million from seven Firm customers. From May 2009 through August 2014, Schmidt violated NASD Rule 3030 and FINRA Rules 3270 and 2010 by engaging in outside business activities without notifying the Firm. Additionally, between 2009 and 2014, Schmidt violated FINRA Rule 2010 by submitting to the Firm five false compliance questionnaires and three false disclosures of outside business activities and loans. Schmidt also violated FINRA Rules 8210 and 2010 by failing to respond to a FINRA request for documents and information issued pursuant to FINRA RuIe 8210.

Page 2 of the Schmidt AWC

Gee . . . that sounds pretty close to the fact pattern set forth in the Lincoln AWC but, you know, it could just be a similar situation. I wonder if there is anything more for us to go on in the Schmidt AWC. After all, I don't want to draw any unwarranted connections given the pains that FINRA has gone to in order to conceal "RS's" real identity.

Let's add this additional information into the mix. Even given the somewhat persuasive common issues described in the above summary from the Schmidt AWC, we're still not certain that this all involved Hawaiian real estate or a vacation rental property. Eureka! Look at what else is set forth in the Schmidt AWC:

In or around May 2009, Schmidt purchased a real estate investment in Hawaii, which he developed into a vacation rental property that opened for business in or around May 2012. Schmidt was the sole owner and operator of the property and the business . . .

Okay, frankly, that's gonna do it for me. I am going out on a limb and asserting that there is a really good chance that the "RS" referenced in the Lincoln AWC is, in fact, the "Raymond Daniel Schmidt" referenced in the Schmidt AWC.

So, what the hell happened to this Respondent Schmidt after FINRA uncovered the whole Hawaii vacation property undisclosed OBA, the borrowing from customers, and Schmidt's apparent failure to fully cooperate in the regulator's investigation? In accordance with the terms of the Schmidt AWC, FINRA imposed upon Schmidt a Bar from association with any FINRA-regulated broker-dealer in any capacity.

Schmidt Pending Customer Disputes

By way of adding icing to the cake, consider that under the heading "Customer Dispute - Pending," on Schmidt's online BrokerCheck, we have two disclosures. FINRA member firm LPL reported that it had been served with notice of a lawsuit in California state court on December 5, 2014, seeking $375,000 in damages based upon allegations that:

COMPLAINT ALLEGES BREACH OF FIDUCIARY DUTY, BREACH OF CONTRACT-PROMISSORY NOTE, CONSTRUCTIVE FRAUD, ELDER ABUSE, UNFAIR BUSINESS PRACTICES, VIOLATION OF CA CORPORATE LAW, SALE OF UNREGISTERED SECURITIES, AND PROFESSIONAL NEGLIGENCE, RELATING TO PLAINTIFF'S INVESTMENTS IN A HAWAII REAL ESTATE PROJECT THROUGH A PROMISSORY NOTE ISSUED BY FORMER LPL ADVISOR.

In a second BrokerCheck disclosure, LPL reported that it had been served with notice of a lawsuit in California state court on November 11, 2015, seeking $850,446.57 in damages based upon allegations that:

PLAINTIFFS ALLEGE BREACH OF FIDUCIARY DUTY, BREACH OF CONTRACT-MORTGAGE LOAN NOTES, CONSTRUCTIVE FRAUD, UNFAIR BUSINESS PRACTICES, VIOLATION OF CA CORPORATIONS LAWS, AND PROFESSIONAL NEGLIGENCE, IN CONNECTION WITH LOANS THEY MADE TO REPRESENTATIVE IN 2011 AND 2012 TOTALING $850,446.57 TO DEVELOP INVESTMENT PROPERTY.

FINRA barred Schmidt and he was named in two civil suits alleging over $1 million in damages; and this is the same fine fellow that FINRA only references as "RS" in the Lincoln AWC? And the reason for affording Schmidt that extra oomph of secrecy is just what exactly? Keep in mind that FINRA barred Schmidt in March 2015, nearly 1 1/2 years before FINRA fined and suspended Lincoln.

But what about the identity of "CK?" Will we ever be able to crack that FINRA code too?

Kerber AWC

The Kerber AWC asserts that Kerber had entered the industry in 2004 and registered with LPL in August 2012, where she remained until she terminated her affiliation as a General Securities Representative with LPL on May 27, 2014. The Kerber AWC asserts that Kerber continued to work at LPL in a "advisory capacity" until her "voluntary termination" in January 2015. The Kerber AWC asserts that Kerber had no prior disciplinary history in the securities industry.

Could this Respondent Kerber possibly be the "CK" referenced in the Lincoln AWC? Based upon a reading of the Kerber AWC , there should be no doubt that we have cracked the last bit of FINRA's code. Consider this persuasive passage from the Kerber AWC:

Making false statements to a FINRA regulated broker?dealer violates FINRA Rule 2010, which requires associated persons to observe high standards of commercial honor and just and equitable principles of trade.ln or around May 2009 and April 2012, Kerber loaned funds to RS, a registered representative associated with the Firm. Kerber was also RS's customer at theFirm. RS used the funds that Kerber loaned him to purchase real estate in Hawaiiand construct a vacation rental property on the premises, which opened for business in 2012. By as early as 2012, Kerber knew that RS was operating a business on the property.In May 2013, Kerber submitted a compliance questionnaire to the Firm which asked Kerber, among other things, "Have you, or any related person or entity, borrowed or loaned any money or securities from or to another individual or entity"? Kerber answered "No." Because Kerber had loaned funds to RS in May 2009 and April 2012 which had not been repaid by this time, this statement was false.,In August 2013. Kerber submitted a disclosure form to the Firm which described the purpose of Kerber's loans to RS. In the form, Kerber told the Firm that the purpose of her loan to RS was for construction of his "home." Because Kerber knew by this time that her loan to RS was for a vacation rental property that RS was operating as a business, this statement was false.By making false statements to her FlNRA regulated broker-dealer employer,Kerber violated FINRA Rule 2010.

Page 2 of the Kerber AWC

Again with that "RS" crap. In accordance with the terms of the Kerber AWC, FINRA imposed upon Kerber a $5,000 fine and a two-month suspension from associating with any FINRA member in any capacity.

A Victory Lap

Why do I make such a big deal about FINRA's apparent policy -- inconsistent as it may appear at times -- that hides the identities of respondents who have previously been sanctioned by the self-regulatory organization? In large part it is because I often chastise public investors for failing to do adequate due diligence before making investments. Similarly, I admonish the public to carefully check out the bona fides of any broker-dealer, registered investment adviser, or fund that they may send their hard-earned savings to; and, accordingly, I warn those same investors to make sure that they know who the individual registered person is that they are trusting to soundly invest their funds.

I would argue, and do so forcefully, that at the very least, FINRA should have cross-referenced the full identity of "RS" as "Raymond Daniel Schmidt" in both the Lincoln AWC and the Kerber AWC, even if only in a footnote. Given that Respondent Schmidt was barred by FINRA, in 2015, I see no defensible purpose that is served by the self-regulatory organization only referencing Schmidt as "RS" in the 2016 Lincoln and Kerber AWCs.